Examining Transportation Oil Demand

There are over a billion cars globally and over 200 million in the US. The world can produce ~85 million vehicles per year. It would still take over a decade to replace the global car fleet with electric models assuming no growth in total car numbers. Many think that oil demand can't fall faster than this replacement rate or that only autonomous electric taxis can speed the process up. The vehicle count and oil demand relationships are more complex.

Where Does a Barrel of Crude Go?

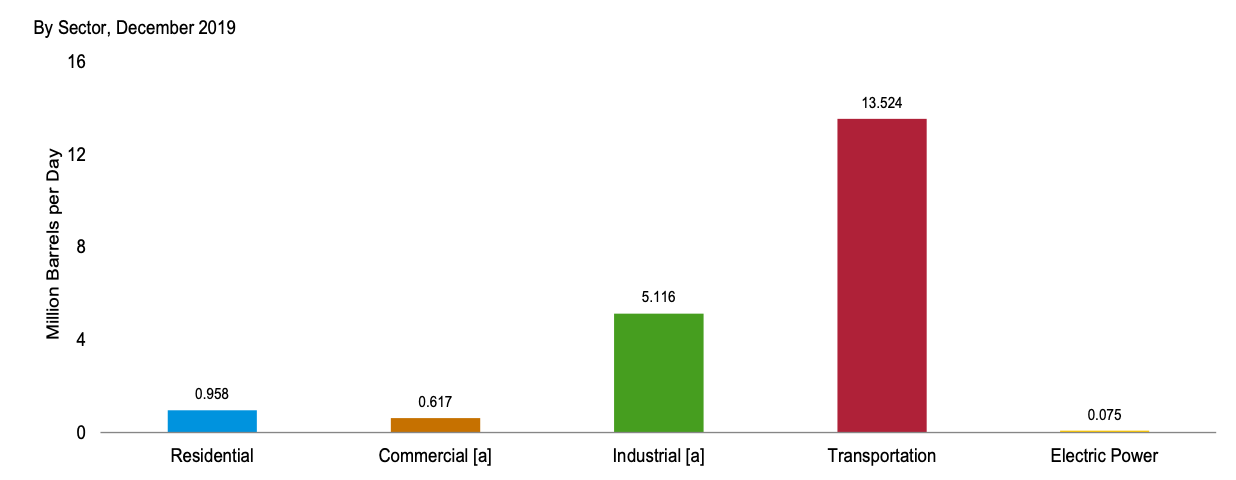

Crude oil is a mixture that varies widely based on the geological conditions it developed in. It can contain gases, liquids, waxes, and asphalt. Transportation, industry, commercial, and residential sectors are the significant crude users in the US.

Source: EIA

Roughly 90% of the liquid products go to transportation. A small amount goes towards heating oil and industrial processes. Asphalt, wax, petroleum gases, and other products make up most industrial crude oil demand.

Source: Data from EIA

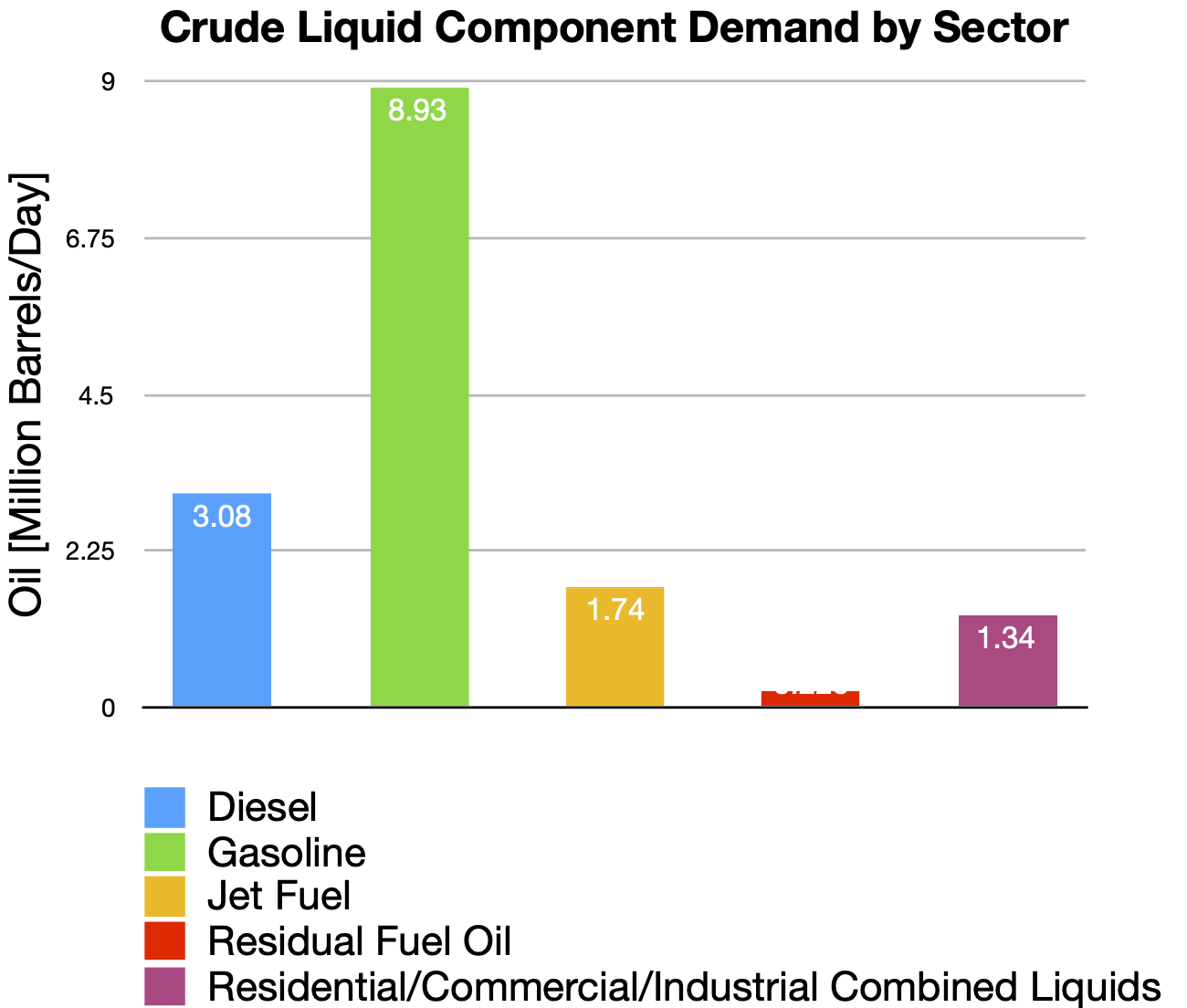

Transportation fuels in the US are gasoline for cars and other light vehicles, diesel for trucks (like semis), buses, or trains, jet fuel for planes, and residual fuel oil for ships. Only 2%-3% of passenger vehicles use diesel.

Transportation is the driver for crude demand. Refineries have techniques like catalytic cracking that turn heavier wax and asphalt into diesel and gasoline. They have some flexibility to adjust the product mix. Extreme changes would likely need facility retrofits and possibly cause market dislocations for minor components like lubricants.

The Commute is Overrated

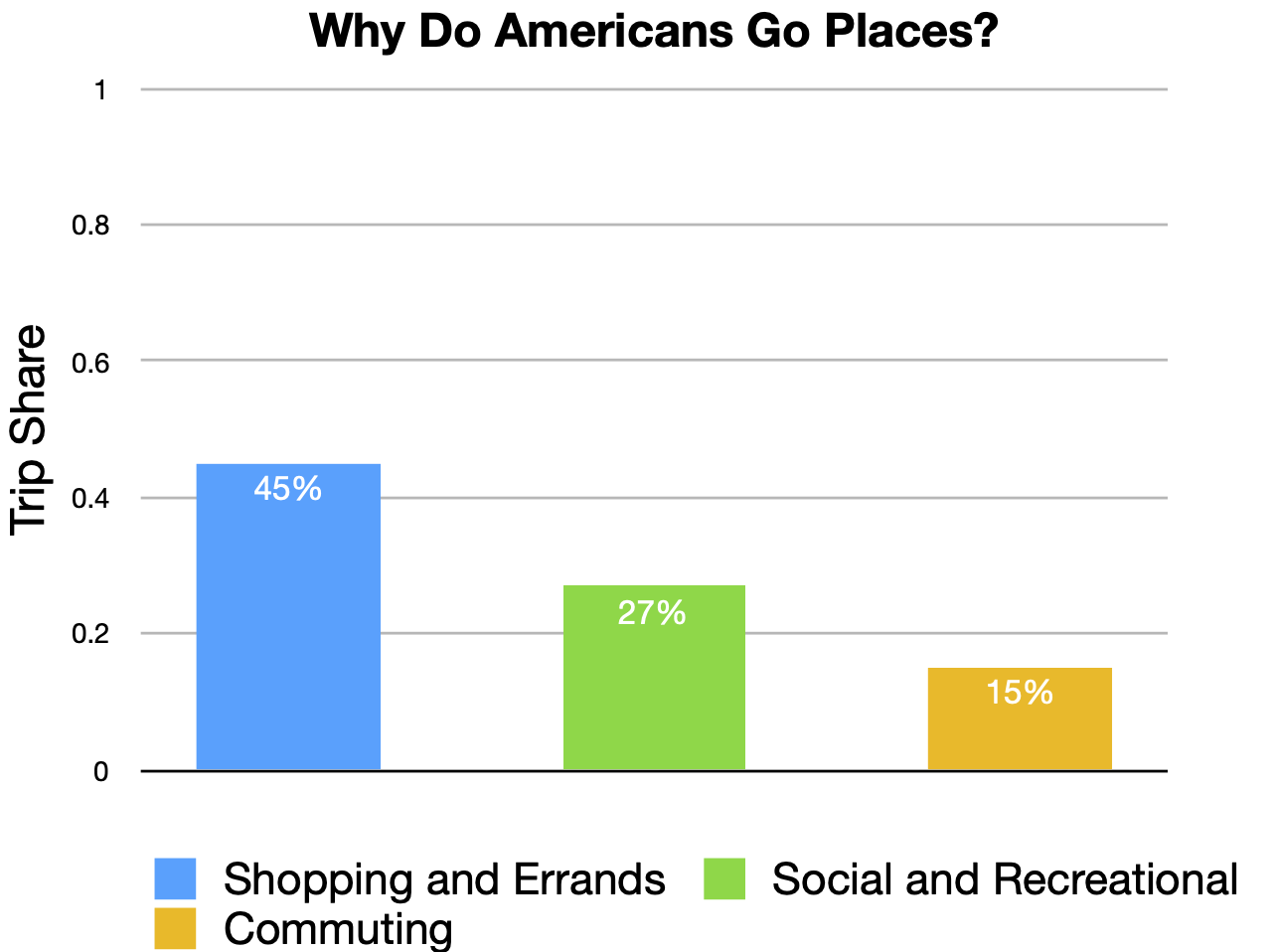

Americans drive everywhere they go - 87% of trips are by car. But only 15% of household trips and 27% of household miles are for commuting to work. Household miles are only two-thirds of total vehicle miles, and the numbers are pre-COVID and reflect lower telecommuting shares.

Source: Bureau of Transportation Statistics

Most trips are for errands, visiting friends, and other non-commuting purposes. The heterogeneity of trips opens up cars to unbundling and oil demand falling faster than gasoline car numbers.

Death by 1000 Cuts

Gasoline cars will sit in garages for a long time to come. That doesn't mean their yearly mileage will stay the same.

The Improving Economics of Electric Vehicles

Electric vehicles have lower operating costs than internal combustion engine cars and trucks. These savings come from lower fuel usage and less maintenance. They are usually more expensive to buy upfront because batteries are costlier than fuel tanks. As batteries decline in cost, more applications become economical to switch to electric vehicles and applications with higher annual mileage crossover first. Electric vehicles are already cheaper upfront in applications like delivery vans and will be for virtually every application by 2030.

Bots and Vans Take on Errands

Shopping and errands make up 45% of household trips. Amazon, Instacart, and other delivery companies keep growing their market share. Instead of a typical household driving 10-15 miles per day for errands, a vehicle serves multiple families driving 80-100 miles per day.

Vans and Cargo Bikes

Applications with predictable miles are the sweet spot for electrification. There is no need for a 400-mile battery pack "just in case." Driving lots of miles makes the operating cost reduction from electrification payoff sooner. The replacement cycle for these vehicles is faster because they accrue more miles per year.

Electric vans are already cheaper than gasoline vans in most delivery applications. The adoption speed limit is set by how fast automakers can design and build new electric vans.

In dense cities, electric cargo bikes are cheaper than vans. Their agility allows them to make deliveries faster and their smaller range and capacity isn't a problem.

Bots

Vans on long routes work well for less time-sensitive deliveries that are non-perishable. Bots look to take on time-sensitive deliveries.

The smallest class of vehicles, the sidewalk bot, is already scaling rapidly. The smaller and slower the bot, the easier it is to automate. The consequences of a fifty-pound sidewalk robot hitting something at four miles per hour is dramatically smaller than a five-thousand-pound car hitting something at sixty miles per hour. The result is that sidewalk bots have already completed millions of deliveries even as their numbers continue to grow.

Bike lane bots are the next size up and excel at small grocery orders. They go faster, further, and weigh more. They are still in testing but promise grocery delivery at a fraction of what Instacart must charge. Companies like Wal-Mart are already building partially automated grocery warehouses that allow employees to load bots without being forced to traverse the regular store.

Mini-car size bots like Nuro round out the list. Automation is still easier than robot taxis. The vehicle does not need to protect occupants, plus it can travel at reasonable 30 mph speeds and avoid congested streets. Nuro bots have been in testing for Wal-Mart and Dominoes.

Others think bots will travel in tunnels instead of on roads. Pipedream Labs hopes to use bots in a 12" tube to deliver groceries and packages to your house. Like fiber internet, this promises better and cheaper service but slower rollout times due to intensive CAPEX.

The upshot is that large numbers of gasoline car trips can be done cheaper and more conveniently with electric vehicles. These technologies are much more mature than robot taxis.

Moving Humans

Mode shifting promises to reduce oil demand even without autonomous taxis.

Long Car Trips

Cars dominate trips of less than five hundred miles. The hassle of large airports negates the speed of the plane. 6-18 passenger electric commuter planes flying from small airports promise to change the math. The savings from fuel and maintenance mean these flights will be cheaper and faster than driving.

Trips over 100 miles make up around 15% of total household vehicle miles. Electric commuters eating that share would double air passenger miles assuming only one person per car. Air passenger miles are already over 10x higher than transit passenger miles.

These aircraft can eat more traditional hub and spoke flights than their 400-500 miles starting range suggests because of improving battery energy density and their use of small airports. The possible impact is millions of barrels per day in the US alone.

One startup decided to make an electric sea glider instead of a commuter plane because the FAA is slam-packed with applications and won't review new ones for years. Sea glider approvals go through a different department with a shorter line. Better batteries and electric motors kicked off a sprint that will start to see fruition in the late 2020s - assuming some startups live through the FAA process.

E-Bikes and Scooters

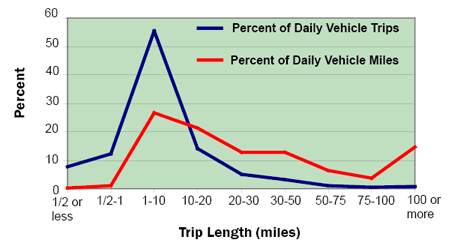

People like riding e-bikes better than regular bikes because they can go faster and further. Many trips in cities are quicker on bikes than in a car. Trips under 10 miles make up the majority of trips and around 30% of vehicle miles.

Source: Average Trip Miles: Federal Highway Administration – 2008

The main holdup is cities building protected cycling infrastructure that makes riders feel safe. The infrastructure itself is cheap, but it is time-consuming working through planning and engineering departments. Ridership can jump rapidly once that infrastructure does come. The leading cycling cities can have almost 50% of trips done on bikes.

Rental bikes and scooters also have piles of potential. Early deployments were controversial, but things died down because the vehicles were expensive to charge and maintain. Newer models are more durable, and partial autonomy promises to increase value. When humans are riding, the humans steer. The scooter drives itself when there is no rider. The scooter can reposition to a better area, park itself correctly, move to a charger, or head to the location of the next rider. Costs go down while value goes up. Like the sidewalk bots, the technical challenge is manageable, especially with teleoperators that can intervene when there is trouble.

Light electric vehicles pair well with Bus Rapid Transit (BRT). BRT lines are another inexpensive technology that is difficult to move through city bureaucracies. BRT and light electric vehicles could provide speedy mass transit to American cities of any density without breaking the budget.

Within Household Substitution

Multi-car households tend to have one car that sees more miles because of a longer commute or always being used for joint trips. If a family buys one electric vehicle, it would be rational to use that car as much as possible due to its lower operating costs.

Robot Taxi Revolution?

Tony Seba is known for his radical opinion on electric, autonomous vehicles. Several years ago, he predicted rapid adoption of electric robot taxis that would be cheaper to use than owning a gasoline car. We'd send our gasoline cars to the scrap heap and ride electric Ubers.

Instead, we have seen incremental progress. Firms like Tesla, Comma.ai, and Mobileye keep improving their inexpensive driver-assistance software, but it still needs supervision. Competitors like Waymo and Cruise have built expensive, fully autonomous highway speed vehicles geofenced to small areas. Slow speed and fixed-route driverless bots and trucks have also made progress.

The flexibility of electric drive trains means that even if we get driverless cars, other form factors will unbundle many car trips. Traffic makes unbundling even more likely. A Seba vision world would lead to vehicle miles roughly doubling from additional empty trips between fares, not accounting for new demand. The autonomous revolution requires reforms to price road access and increase capacity through new tunnels, toll roads, or using current road space more efficiently. Regulatory hurdles and environmental reviews that drag on for years ensnare congestion pricing schemes like New York City's. Cheaper and more convenient substitutes, like delivery bots and e-bikes, should have strong demand.

Falling consumer oil demand looks much more like driving the Camry 6000 miles per year instead of 12,000 miles rather than a shiny new electric car in every garage or robot taxis swarming everywhere.

Medium and Heavy Trucks

Trucks use about a quarter of ground transportation fuel. Their electrification promises to have an outsize impact on oil demand.

The Technical and Economic Challenges

Until recently, most believed that long-distance battery-powered trucks were not possible. Automakers try to make electric passenger cars as light as possible to improve their range. Trucks carry heavy loads that sap batteries. But if you use high-energy-density battery cells, take care to reduce wheel friction, and have an aerodynamic design, you can make a practical truck. The Tesla Semi drives 10 hours per day (the legal limit for drivers) and only charges on breaks. Its total cost is lower than diesel trucks.

The Tesla Semi is not in mass production. The reason is that it is a battery hog. And the batteries it needs are nickel-based cells that are in short supply. Tesla makes more money putting nickel cells into luxury cars than semis. The chip shortage doesn't help, either. Designs like the Tesla Semi won't come to fruition until energy-dense cells are more available.

There is also a long tail of trucks and buses that run less often. An example is a farmer's truck he only uses for harvest. But most of the fuel usage comes from the everyday trucks that are first in line to switch.

Automation Changes the Equation

In response to the shortage of nickel-based cells, automakers are trying to substitute lithium-ferro-phosphate (LFP) cells into vehicles. LFP batteries are not as energy-dense as the lithium nickel chemistries like NCA or NMC. The lower energy density poses a problem for heavy trucks because it diminishes their range. Adding more batteries adds more weight and takes away weight for hauling goods. While LFP might work for local trucks running on "bread routes," they don't work for long distances. Drivers would waste hours charging instead of driving.

Automation alters the numbers. A self-driving truck doesn't care how many times it has to charge or when it has to, only the total charging time. LFP charges as fast as nickel-based chemistries. A robot driver can stop more times to recharge with minor time losses and can drive many more hours of the day. The total time charging is roughly 15% when using superchargers. Lower operating costs overwhelm any advantage a driverless diesel truck would have in hours driven.

Most trucking automation improvements are incremental. An example is Wal-Mart using limited numbers of driverless trucks. They travel between stores and distribution centers on fixed routes, making the automation challenge easier. In the same spirit, trucks may only be driverless on interstates at first. Trucks can drive themselves between cities while local drivers meet them and drive them to the final destination. Trucks increase utilization, and truck drivers get much better jobs.

Gauging the Potential

BLS estimates that there are two million heavy truck drivers in the US. In 2019 there were 281,000 sales of Class 8 Trucks (semis), and some of these drivers likely drive smaller trucks. Truckers replace their trucks more often than passenger cars because a fully utilized truck might be driving 200,000 miles per year. Partially automated trucks could double the yearly mileage by bypassing driver hour limits. The active fleet could meet the target for complete electrification in less than four years if one million trucks are the target.

Traditional trucks have unique engines, transmissions, fuel tanks, and emissions abatement technologies. Electric trucks can share components with passenger cars. Tesla designed their Semi to share motors, inverters, battery packs, and other accessories with the Model 3 sedan and Model Y crossover. Production can ramp quickly and benefit from economies of scale.

Once more nickel mines open or partial automation allows LFP batteries, the transition can happen quickly. A partially autonomous electric truck would reduce trucking costs by 50%-70%. Road pricing and capacity increases become a requirement as that pricing would increase shipping demand and induce switching from trains. Electric commuter planes could clear up space by removing cars from interstates.

For whatever reason, charging seems to be a popular topic. Chargers are simpler than fuel pumps and underground tanks. Tiny startups like Tesla pre-2015 were able to finance a nationwide charging system that covered most interstates. There are standalone charging businesses competing as well. Adding strategic chargers along interstates or at existing truck stops seems well within the market's capability.

Trucking fuel demand could see a several million barrels per day decrease in the US in a relatively short period through electrification and the spread of automation.

The Impact on the Oil Industry

Electrification is terrible for oil companies. Or is it?

Predicting Future Oil Demand

Predicting usage is difficult, but demand has a gravity to it. OECD countries have already decreased oil demand for decades while all increases have come from emerging markets, especially China. Automakers can only manufacture new cars and trucks so fast. Electrification will speed up OECD demand decline while blunting increases from emerging markets.

Before the pandemic, I thought peak demand would happen around 2027. It seems more likely now that peak demand was 2019, and we will see a plateau before significant decreases around 2030.

Oil Prices and Profits

Even small changes in the supply/demand balance move oil prices dramatically. Both supply and demand are relatively inflexible, so the pace of electrification matters. If oil demand decreases by 2% per year, oil companies could still have bumper profits. Each year existing production declines 5%-7%, so prices must reflect the cost of finding and developing new supplies even at 2% yearly declines.

The nightmare scenarios mostly happen for oil companies when demand decreases faster than natural decline. COVID showed us what that looks like with massive short-term demand destruction and oil markets going haywire. A similar disjointed market seems unsustainable early in the transition because gasoline and diesel users see low prices that delay switching to electric options.

It may seem like a 5%-7% decline is the limit for demand decline, but that isn't true. The United States used increasing domestic production to cover sanctions or interventions in Libya, Iran, and Venezuela that reduced oil production. Woe is to Mohammed bin Salman if he saws up another journalist when oil is $20 per barrel and demand is declining swiftly. Liberals, environmentalists, the oil lobby, and every other American would favor sanctions on Saudi oil.

Being an American oil producer might not be so bad as long as you can weather short periods of ultra-low prices.

Long Term Competition from Synthetic Fuels

Liquid fuels are difficult to displace from long-distance planes, ships, and plastics manufacturing. Because liquid fuels are pricey on an energy basis, synthetic fuels using dirt-cheap solar or wind could be economical. $60 per barrel of oil equates to ~$35/MWh. New solar is under $30/MWh today. Assuming a conversion efficiency of around 33%, the breakeven to make fuels would be ~$12/MWh. That is well within possible future non-grid tied solar technology costs.

Synthetic production pathways tend to produce relatively pure products. The barrel of crude could be unbundled, similar to how car trips might be. Changes in transportation demand could incentivize a wide range of new production capacity in chemicals that aren't classic synthetic fuels to replace crude byproducts.

Once synthetic fuels are below the marginal finding cost of oil, operators will only produce existing reserves. Traditional oil reserves can stay viable much longer than natural gas in competition with synthetic fuels. Gas has higher fixed costs that synthetic fuels can exploit. Transporting oil is so cheap that low production cost reservoirs can produce long into the future without government intervention.

A $100/tonne carbon tax adds ~$43 to a barrel of oil. Taxes would have to be steep to eliminate production that often has total costs under $20 per barrel. Many barrels will be going into industrial uses and won't burn, anyway. Cheap direct air capture technology can make existing oil reserves more valuable because it makes it harder for synthetic fuels to compete if it sets a cap on carbon taxes.

The economics of future oil production are hard to predict.

The Transition is Picking Up Steam

My original guestimate on peak demand comes from the difficulty of building millions of cars, trucks, planes, and batteries. E-bikes and other light electric vehicles are the only technology that could surprise. Their constraint is local governments' desire to build infrastructure.

Once more factories start up, the pace will hit an inflection point. Oil demand will start falling at a rate that allows high enough oil prices to continue to incentivize switching. There will be stops and starts or switching back and forth, similar to how natural gas and renewables are displacing coal in the US electricity market. Eventually, oil-burning capacity will retire, and there will be little support or service for more expensive internal combustion engines.

Oil sales will eventually stabilize as applications like plastics and jet fuel make up an increasing portion of demand. Traditional oil production will become a sleepy industry as synthetic fuels emerge and set the marginal cost, stopping most new development. The more oil production Americans take off the market through war or sanctions, the smaller the rump of traditional producers will be.

The diverse applications of electric power trains combined with increasing automation and a wide variety of battery chemistries promise to revolutionize transport and transport fuels.

-

VMT Data

-

Deeper VMT Analysis

The Electric Car's Shrinking Role in Reducing Oil Demand

2022 March 21 Twitter Substack See all postsTrucks, vans, and other high mileage vehicles promise to impact oil demand more than EVs.

Examining Transportation Oil Demand

There are over a billion cars globally and over 200 million in the US. The world can produce ~85 million vehicles per year. It would still take over a decade to replace the global car fleet with electric models assuming no growth in total car numbers. Many think that oil demand can't fall faster than this replacement rate or that only autonomous electric taxis can speed the process up. The vehicle count and oil demand relationships are more complex.

Where Does a Barrel of Crude Go?

Crude oil is a mixture that varies widely based on the geological conditions it developed in. It can contain gases, liquids, waxes, and asphalt. Transportation, industry, commercial, and residential sectors are the significant crude users in the US.

Source: EIA

Roughly 90% of the liquid products go to transportation. A small amount goes towards heating oil and industrial processes. Asphalt, wax, petroleum gases, and other products make up most industrial crude oil demand.

Source: Data from EIA

Transportation fuels in the US are gasoline for cars and other light vehicles, diesel for trucks (like semis), buses, or trains, jet fuel for planes, and residual fuel oil for ships. Only 2%-3% of passenger vehicles use diesel.

Transportation is the driver for crude demand. Refineries have techniques like catalytic cracking that turn heavier wax and asphalt into diesel and gasoline. They have some flexibility to adjust the product mix. Extreme changes would likely need facility retrofits and possibly cause market dislocations for minor components like lubricants.

The Commute is Overrated

Americans drive everywhere they go - 87% of trips are by car. But only 15% of household trips and 27% of household miles are for commuting to work. Household miles are only two-thirds of total vehicle miles, and the numbers are pre-COVID and reflect lower telecommuting shares.

Source: Bureau of Transportation Statistics

Most trips are for errands, visiting friends, and other non-commuting purposes. The heterogeneity of trips opens up cars to unbundling and oil demand falling faster than gasoline car numbers.

Death by 1000 Cuts

Gasoline cars will sit in garages for a long time to come. That doesn't mean their yearly mileage will stay the same.

The Improving Economics of Electric Vehicles

Electric vehicles have lower operating costs than internal combustion engine cars and trucks. These savings come from lower fuel usage and less maintenance. They are usually more expensive to buy upfront because batteries are costlier than fuel tanks. As batteries decline in cost, more applications become economical to switch to electric vehicles and applications with higher annual mileage crossover first. Electric vehicles are already cheaper upfront in applications like delivery vans and will be for virtually every application by 2030.

Bots and Vans Take on Errands

Shopping and errands make up 45% of household trips. Amazon, Instacart, and other delivery companies keep growing their market share. Instead of a typical household driving 10-15 miles per day for errands, a vehicle serves multiple families driving 80-100 miles per day.

Vans and Cargo Bikes

Applications with predictable miles are the sweet spot for electrification. There is no need for a 400-mile battery pack "just in case." Driving lots of miles makes the operating cost reduction from electrification payoff sooner. The replacement cycle for these vehicles is faster because they accrue more miles per year.

Electric vans are already cheaper than gasoline vans in most delivery applications. The adoption speed limit is set by how fast automakers can design and build new electric vans.

In dense cities, electric cargo bikes are cheaper than vans. Their agility allows them to make deliveries faster and their smaller range and capacity isn't a problem.

Bots

Vans on long routes work well for less time-sensitive deliveries that are non-perishable. Bots look to take on time-sensitive deliveries.

The smallest class of vehicles, the sidewalk bot, is already scaling rapidly. The smaller and slower the bot, the easier it is to automate. The consequences of a fifty-pound sidewalk robot hitting something at four miles per hour is dramatically smaller than a five-thousand-pound car hitting something at sixty miles per hour. The result is that sidewalk bots have already completed millions of deliveries even as their numbers continue to grow.

Bike lane bots are the next size up and excel at small grocery orders. They go faster, further, and weigh more. They are still in testing but promise grocery delivery at a fraction of what Instacart must charge. Companies like Wal-Mart are already building partially automated grocery warehouses that allow employees to load bots without being forced to traverse the regular store.

Mini-car size bots like Nuro round out the list. Automation is still easier than robot taxis. The vehicle does not need to protect occupants, plus it can travel at reasonable 30 mph speeds and avoid congested streets. Nuro bots have been in testing for Wal-Mart and Dominoes.

Others think bots will travel in tunnels instead of on roads. Pipedream Labs hopes to use bots in a 12" tube to deliver groceries and packages to your house. Like fiber internet, this promises better and cheaper service but slower rollout times due to intensive CAPEX.

The upshot is that large numbers of gasoline car trips can be done cheaper and more conveniently with electric vehicles. These technologies are much more mature than robot taxis.

Moving Humans

Mode shifting promises to reduce oil demand even without autonomous taxis.

Long Car Trips

Cars dominate trips of less than five hundred miles. The hassle of large airports negates the speed of the plane. 6-18 passenger electric commuter planes flying from small airports promise to change the math. The savings from fuel and maintenance mean these flights will be cheaper and faster than driving.

Trips over 100 miles make up around 15% of total household vehicle miles. Electric commuters eating that share would double air passenger miles assuming only one person per car. Air passenger miles are already over 10x higher than transit passenger miles.

These aircraft can eat more traditional hub and spoke flights than their 400-500 miles starting range suggests because of improving battery energy density and their use of small airports. The possible impact is millions of barrels per day in the US alone.

One startup decided to make an electric sea glider instead of a commuter plane because the FAA is slam-packed with applications and won't review new ones for years. Sea glider approvals go through a different department with a shorter line. Better batteries and electric motors kicked off a sprint that will start to see fruition in the late 2020s - assuming some startups live through the FAA process.

E-Bikes and Scooters

People like riding e-bikes better than regular bikes because they can go faster and further. Many trips in cities are quicker on bikes than in a car. Trips under 10 miles make up the majority of trips and around 30% of vehicle miles.

Source: Average Trip Miles: Federal Highway Administration – 2008

The main holdup is cities building protected cycling infrastructure that makes riders feel safe. The infrastructure itself is cheap, but it is time-consuming working through planning and engineering departments. Ridership can jump rapidly once that infrastructure does come. The leading cycling cities can have almost 50% of trips done on bikes.

Rental bikes and scooters also have piles of potential. Early deployments were controversial, but things died down because the vehicles were expensive to charge and maintain. Newer models are more durable, and partial autonomy promises to increase value. When humans are riding, the humans steer. The scooter drives itself when there is no rider. The scooter can reposition to a better area, park itself correctly, move to a charger, or head to the location of the next rider. Costs go down while value goes up. Like the sidewalk bots, the technical challenge is manageable, especially with teleoperators that can intervene when there is trouble.

Light electric vehicles pair well with Bus Rapid Transit (BRT). BRT lines are another inexpensive technology that is difficult to move through city bureaucracies. BRT and light electric vehicles could provide speedy mass transit to American cities of any density without breaking the budget.

Within Household Substitution

Multi-car households tend to have one car that sees more miles because of a longer commute or always being used for joint trips. If a family buys one electric vehicle, it would be rational to use that car as much as possible due to its lower operating costs.

Robot Taxi Revolution?

Tony Seba is known for his radical opinion on electric, autonomous vehicles. Several years ago, he predicted rapid adoption of electric robot taxis that would be cheaper to use than owning a gasoline car. We'd send our gasoline cars to the scrap heap and ride electric Ubers.

Instead, we have seen incremental progress. Firms like Tesla, Comma.ai, and Mobileye keep improving their inexpensive driver-assistance software, but it still needs supervision. Competitors like Waymo and Cruise have built expensive, fully autonomous highway speed vehicles geofenced to small areas. Slow speed and fixed-route driverless bots and trucks have also made progress.

The flexibility of electric drive trains means that even if we get driverless cars, other form factors will unbundle many car trips. Traffic makes unbundling even more likely. A Seba vision world would lead to vehicle miles roughly doubling from additional empty trips between fares, not accounting for new demand. The autonomous revolution requires reforms to price road access and increase capacity through new tunnels, toll roads, or using current road space more efficiently. Regulatory hurdles and environmental reviews that drag on for years ensnare congestion pricing schemes like New York City's. Cheaper and more convenient substitutes, like delivery bots and e-bikes, should have strong demand.

Falling consumer oil demand looks much more like driving the Camry 6000 miles per year instead of 12,000 miles rather than a shiny new electric car in every garage or robot taxis swarming everywhere.

Medium and Heavy Trucks

Trucks use about a quarter of ground transportation fuel. Their electrification promises to have an outsize impact on oil demand.

The Technical and Economic Challenges

Until recently, most believed that long-distance battery-powered trucks were not possible. Automakers try to make electric passenger cars as light as possible to improve their range. Trucks carry heavy loads that sap batteries. But if you use high-energy-density battery cells, take care to reduce wheel friction, and have an aerodynamic design, you can make a practical truck. The Tesla Semi drives 10 hours per day (the legal limit for drivers) and only charges on breaks. Its total cost is lower than diesel trucks.

The Tesla Semi is not in mass production. The reason is that it is a battery hog. And the batteries it needs are nickel-based cells that are in short supply. Tesla makes more money putting nickel cells into luxury cars than semis. The chip shortage doesn't help, either. Designs like the Tesla Semi won't come to fruition until energy-dense cells are more available.

There is also a long tail of trucks and buses that run less often. An example is a farmer's truck he only uses for harvest. But most of the fuel usage comes from the everyday trucks that are first in line to switch.

Automation Changes the Equation

In response to the shortage of nickel-based cells, automakers are trying to substitute lithium-ferro-phosphate (LFP) cells into vehicles. LFP batteries are not as energy-dense as the lithium nickel chemistries like NCA or NMC. The lower energy density poses a problem for heavy trucks because it diminishes their range. Adding more batteries adds more weight and takes away weight for hauling goods. While LFP might work for local trucks running on "bread routes," they don't work for long distances. Drivers would waste hours charging instead of driving.

Automation alters the numbers. A self-driving truck doesn't care how many times it has to charge or when it has to, only the total charging time. LFP charges as fast as nickel-based chemistries. A robot driver can stop more times to recharge with minor time losses and can drive many more hours of the day. The total time charging is roughly 15% when using superchargers. Lower operating costs overwhelm any advantage a driverless diesel truck would have in hours driven.

Most trucking automation improvements are incremental. An example is Wal-Mart using limited numbers of driverless trucks. They travel between stores and distribution centers on fixed routes, making the automation challenge easier. In the same spirit, trucks may only be driverless on interstates at first. Trucks can drive themselves between cities while local drivers meet them and drive them to the final destination. Trucks increase utilization, and truck drivers get much better jobs.

Gauging the Potential

BLS estimates that there are two million heavy truck drivers in the US. In 2019 there were 281,000 sales of Class 8 Trucks (semis), and some of these drivers likely drive smaller trucks. Truckers replace their trucks more often than passenger cars because a fully utilized truck might be driving 200,000 miles per year. Partially automated trucks could double the yearly mileage by bypassing driver hour limits. The active fleet could meet the target for complete electrification in less than four years if one million trucks are the target.

Traditional trucks have unique engines, transmissions, fuel tanks, and emissions abatement technologies. Electric trucks can share components with passenger cars. Tesla designed their Semi to share motors, inverters, battery packs, and other accessories with the Model 3 sedan and Model Y crossover. Production can ramp quickly and benefit from economies of scale.

Once more nickel mines open or partial automation allows LFP batteries, the transition can happen quickly. A partially autonomous electric truck would reduce trucking costs by 50%-70%. Road pricing and capacity increases become a requirement as that pricing would increase shipping demand and induce switching from trains. Electric commuter planes could clear up space by removing cars from interstates.

For whatever reason, charging seems to be a popular topic. Chargers are simpler than fuel pumps and underground tanks. Tiny startups like Tesla pre-2015 were able to finance a nationwide charging system that covered most interstates. There are standalone charging businesses competing as well. Adding strategic chargers along interstates or at existing truck stops seems well within the market's capability.

Trucking fuel demand could see a several million barrels per day decrease in the US in a relatively short period through electrification and the spread of automation.

The Impact on the Oil Industry

Electrification is terrible for oil companies. Or is it?

Predicting Future Oil Demand

Predicting usage is difficult, but demand has a gravity to it. OECD countries have already decreased oil demand for decades while all increases have come from emerging markets, especially China. Automakers can only manufacture new cars and trucks so fast. Electrification will speed up OECD demand decline while blunting increases from emerging markets.

Before the pandemic, I thought peak demand would happen around 2027. It seems more likely now that peak demand was 2019, and we will see a plateau before significant decreases around 2030.

Oil Prices and Profits

Even small changes in the supply/demand balance move oil prices dramatically. Both supply and demand are relatively inflexible, so the pace of electrification matters. If oil demand decreases by 2% per year, oil companies could still have bumper profits. Each year existing production declines 5%-7%, so prices must reflect the cost of finding and developing new supplies even at 2% yearly declines.

The nightmare scenarios mostly happen for oil companies when demand decreases faster than natural decline. COVID showed us what that looks like with massive short-term demand destruction and oil markets going haywire. A similar disjointed market seems unsustainable early in the transition because gasoline and diesel users see low prices that delay switching to electric options.

It may seem like a 5%-7% decline is the limit for demand decline, but that isn't true. The United States used increasing domestic production to cover sanctions or interventions in Libya, Iran, and Venezuela that reduced oil production. Woe is to Mohammed bin Salman if he saws up another journalist when oil is $20 per barrel and demand is declining swiftly. Liberals, environmentalists, the oil lobby, and every other American would favor sanctions on Saudi oil.

Being an American oil producer might not be so bad as long as you can weather short periods of ultra-low prices.

Long Term Competition from Synthetic Fuels

Liquid fuels are difficult to displace from long-distance planes, ships, and plastics manufacturing. Because liquid fuels are pricey on an energy basis, synthetic fuels using dirt-cheap solar or wind could be economical. $60 per barrel of oil equates to ~$35/MWh. New solar is under $30/MWh today. Assuming a conversion efficiency of around 33%, the breakeven to make fuels would be ~$12/MWh. That is well within possible future non-grid tied solar technology costs.

Synthetic production pathways tend to produce relatively pure products. The barrel of crude could be unbundled, similar to how car trips might be. Changes in transportation demand could incentivize a wide range of new production capacity in chemicals that aren't classic synthetic fuels to replace crude byproducts.

Once synthetic fuels are below the marginal finding cost of oil, operators will only produce existing reserves. Traditional oil reserves can stay viable much longer than natural gas in competition with synthetic fuels. Gas has higher fixed costs that synthetic fuels can exploit. Transporting oil is so cheap that low production cost reservoirs can produce long into the future without government intervention.

A $100/tonne carbon tax adds ~$43 to a barrel of oil. Taxes would have to be steep to eliminate production that often has total costs under $20 per barrel. Many barrels will be going into industrial uses and won't burn, anyway. Cheap direct air capture technology can make existing oil reserves more valuable because it makes it harder for synthetic fuels to compete if it sets a cap on carbon taxes.

The economics of future oil production are hard to predict.

The Transition is Picking Up Steam

My original guestimate on peak demand comes from the difficulty of building millions of cars, trucks, planes, and batteries. E-bikes and other light electric vehicles are the only technology that could surprise. Their constraint is local governments' desire to build infrastructure.

Once more factories start up, the pace will hit an inflection point. Oil demand will start falling at a rate that allows high enough oil prices to continue to incentivize switching. There will be stops and starts or switching back and forth, similar to how natural gas and renewables are displacing coal in the US electricity market. Eventually, oil-burning capacity will retire, and there will be little support or service for more expensive internal combustion engines.

Oil sales will eventually stabilize as applications like plastics and jet fuel make up an increasing portion of demand. Traditional oil production will become a sleepy industry as synthetic fuels emerge and set the marginal cost, stopping most new development. The more oil production Americans take off the market through war or sanctions, the smaller the rump of traditional producers will be.

The diverse applications of electric power trains combined with increasing automation and a wide variety of battery chemistries promise to revolutionize transport and transport fuels.

VMT Data

Deeper VMT Analysis