Current Solar Cost Paradigm

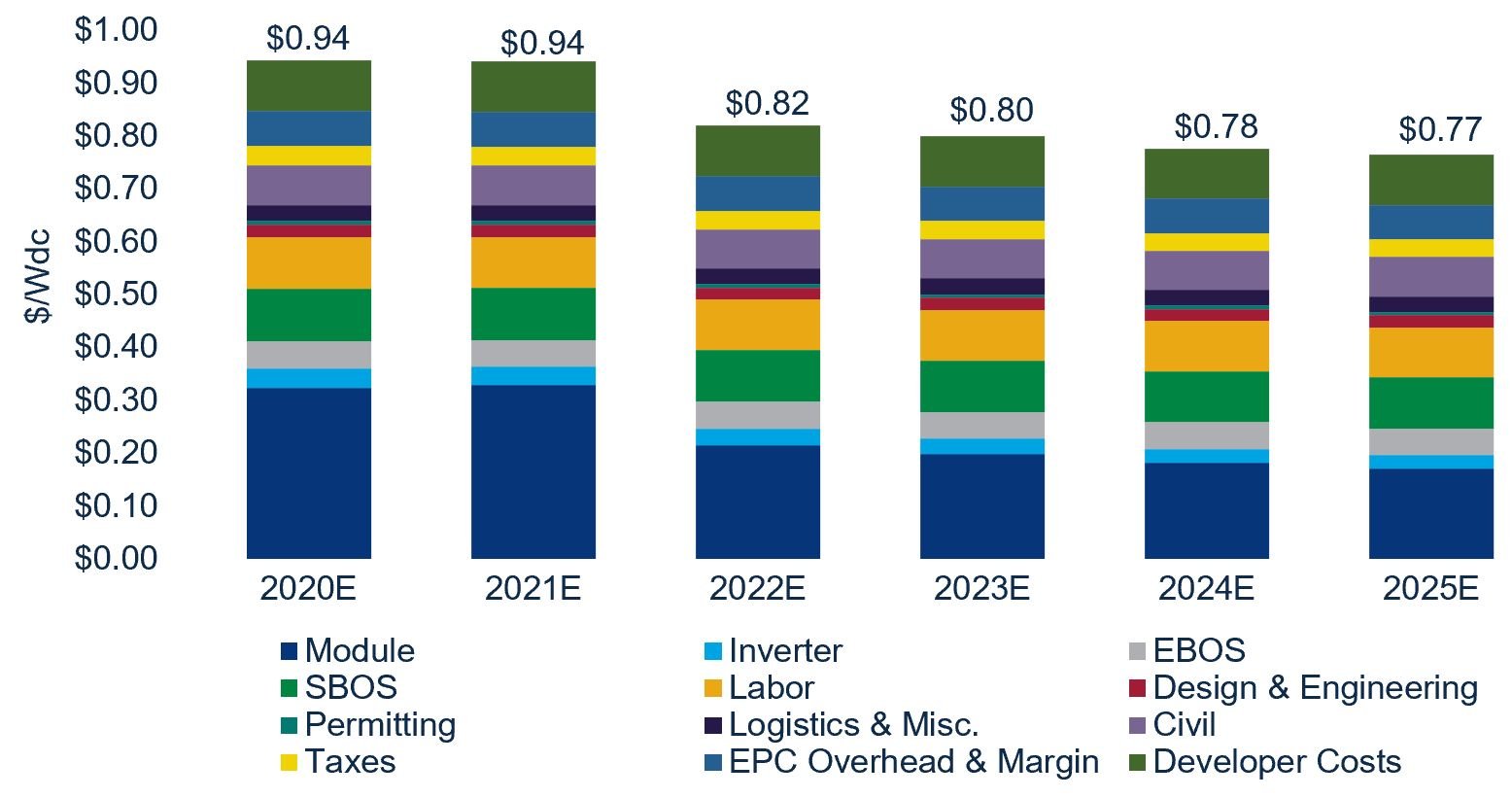

Panels make up a decreasing share of costs.

Balance of System and Soft Costs

Solar panels have seen massive price drops. The cost per watt has fallen ~90% since 2010. Other "soft" or "balance-of-system" costs of solar farms like digging trenches or building steel racks tends to be more stable. Solar panels make up a steadily decreasing share of the total cost of utility-scale solar.

Source: Wood Mackenzie's US Solar PV Pricing H2 2020

Source: Wood Mackenzie's US Solar PV Pricing H2 2020

Developers focus on Increasing the output of each panel to reduce costs. Fewer panels onsite mean reduced grading, racking, and trenching. But, panel output can't be infinite, so remaining costs still impose a practical limit on CAPEX reduction. Decreasing the Levelized Cost of Electricity (LCOE) below $15/MWh is challenging under this paradigm.

Fixed Operating Costs

Operating costs play a significant part in setting the lower bound of solar costs. Jenny Chase cast doubt on ultra-low solar cost estimates (<$10/MWh) in her book "Solar Power Finance Without the Jargon" because of stubborn OPEX. Lazard estimates current OPEX at around $5/MWh.

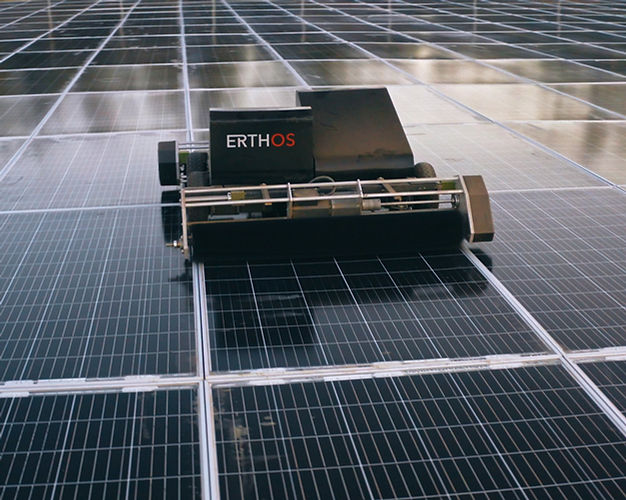

Typical line items are mowing, cleaning dust off panels, and repairing broken parts. Solutions are tough. Goats eat things other than vegetation, robots struggle with angled panels, and it takes a long time to improve equipment failure rates.

Panel Supply Chains are Flexible

Most solar manufacturing steps are flexible. Construction time for new wafer, cell, and module (the completed panel) fabs ranges from 9-18 months. Polysilicon plants can take longer, but manufacturers keep making solar cells thinner to use less silicon, moderating this problem.

The flexible solar supply chain and continued improvement in panels provide an opportunity to substitute panels for balance-of-system costs.

Rethinking Solar Farm Design

"Can we just lay these panels on the ground?"

The Erthos Idea

Most utility-scale solar farms have panels on racks and trackers. Designers highly engineer the steel racking to use as little material as possible. Developers prefer single-axis trackers that increase panel output with fewer moving parts and cost less than dual-axis models. Panels are spread out in lines to prevent shading.

Erthos puts panels directly on the ground with no space between solar panels. Their idea is that racks and trackers worked best for expensive panels, but cheaper panels make them suboptimal. Each solar panel produces less power lying on the ground, but it costs less to install.

A typical solar farm. Source: Rachel McDevitt/StateImpact Pennsylvania

A typical solar farm. Source: Rachel McDevitt/StateImpact Pennsylvania

Panels laid on the ground. Source: Erthos

The CAPEX Benefits of Ditching Racking and Trackers

Putting panels on the ground reduces CAPEX by 20%, according to Erthos. Some of the savings that offset higher solar panel spending:

- Tighter spacing reduces land usage by 2/3.

- The simple layout reduces site preparation, planning, and design expenses.

- 70% less trenching and wiring.

- No racks or trackers.

- Construction time declines 50%.

- Farms can use modules with glass on both sides without the expense of beefier racking. Double-glass panels are more reliable and have longer lifetimes.

The future for this competing paradigm looks much sunnier. It still benefits from panel efficiency and output improvements. Traditional solar farm configurations require racking and tracker redesigns to accommodate larger panels (to reduce wiring). An on-ground system can increase solar panel size with less trouble.

Soft costs decrease as a share of CAPEX, allowing on-ground designs to benefit more from future panel cost decreases.

The Impact on OPEX

Solar on the ground has positive effects on OPEX, too.

- Panels with zero gaps mean no vegetation growing within the farm, lowering mowing costs.

- Flat panels are simple for a Roomba-like robot to clean.

- Eliminating trackers (moving parts) and using double-glass panels reduces maintenance costs.

Lower operating expenses open the possibility of ultra-low solar costs.

Long Term Implications

The Idea is More Powerful Than the Company

Erthos has a good start with several gigawatts under contract. The idea of ground-mount solar seems likely to spread far past them.

Some developers still have questions about how easy maintenance will be, if the flood-rated panels will hold up, or if the design really contains vegetation. The company is avoiding areas with high snow loads for now.

The logic of deleting many subsystems drives savings that make it worth working through a few kinks. Concentrating complexity within mega-factories while simplifying deployment gives solar an advantage in scaling rapidly.

Solar Becomes Industrial

Many environmental groups have already begun to protest solar and wind farms. Ground-mount solar is the industrialization of the solar PV ecosystem.

Solar was OK when it was expensive because it would decrease energy usage. Technology that paves the ground and makes $10/MWh electricity attainable, driving demand up, is not what Greenpeace had in mind.

Solar can still dramatically decrease land use for energy. The US uses 50 million acres just for biofuels. Solar could theoretically meet all current electricity demand plus electrify transport using less than ten million acres. Innovations like ground-mount solar and increasing panel efficiency keep reducing that number.

If solar can meet its potential and deliver $10/MWh prices, we will likely see non-grid-tied solar powering a range of industrial processes. Demand will increase significantly.

Coal is an environmental improvement over cutting down trees. Solar is an improvement on coal but isn't impact-free. Developers will have to navigate scattered opposition like any other energy technology.

The Summary

Solar won't provide 100% of our electricity, but it has a clear path to further price decreases and increasing penetration on grid and off grid.

Simple Solutions Power Solar's Advance

2022 April 19 Twitter Substack See all postsThe solar supply chain is pushing complexity to giant factories.

Current Solar Cost Paradigm

Panels make up a decreasing share of costs.

Balance of System and Soft Costs

Solar panels have seen massive price drops. The cost per watt has fallen ~90% since 2010. Other "soft" or "balance-of-system" costs of solar farms like digging trenches or building steel racks tends to be more stable. Solar panels make up a steadily decreasing share of the total cost of utility-scale solar.

Developers focus on Increasing the output of each panel to reduce costs. Fewer panels onsite mean reduced grading, racking, and trenching. But, panel output can't be infinite, so remaining costs still impose a practical limit on CAPEX reduction. Decreasing the Levelized Cost of Electricity (LCOE) below $15/MWh is challenging under this paradigm.

Fixed Operating Costs

Operating costs play a significant part in setting the lower bound of solar costs. Jenny Chase cast doubt on ultra-low solar cost estimates (<$10/MWh) in her book "Solar Power Finance Without the Jargon" because of stubborn OPEX. Lazard estimates current OPEX at around $5/MWh.

Typical line items are mowing, cleaning dust off panels, and repairing broken parts. Solutions are tough. Goats eat things other than vegetation, robots struggle with angled panels, and it takes a long time to improve equipment failure rates.

Panel Supply Chains are Flexible

Most solar manufacturing steps are flexible. Construction time for new wafer, cell, and module (the completed panel) fabs ranges from 9-18 months. Polysilicon plants can take longer, but manufacturers keep making solar cells thinner to use less silicon, moderating this problem.

The flexible solar supply chain and continued improvement in panels provide an opportunity to substitute panels for balance-of-system costs.

Rethinking Solar Farm Design

"Can we just lay these panels on the ground?"

The Erthos Idea

Most utility-scale solar farms have panels on racks and trackers. Designers highly engineer the steel racking to use as little material as possible. Developers prefer single-axis trackers that increase panel output with fewer moving parts and cost less than dual-axis models. Panels are spread out in lines to prevent shading.

Erthos puts panels directly on the ground with no space between solar panels. Their idea is that racks and trackers worked best for expensive panels, but cheaper panels make them suboptimal. Each solar panel produces less power lying on the ground, but it costs less to install.

Panels laid on the ground. Source: Erthos

The CAPEX Benefits of Ditching Racking and Trackers

Putting panels on the ground reduces CAPEX by 20%, according to Erthos. Some of the savings that offset higher solar panel spending:

The future for this competing paradigm looks much sunnier. It still benefits from panel efficiency and output improvements. Traditional solar farm configurations require racking and tracker redesigns to accommodate larger panels (to reduce wiring). An on-ground system can increase solar panel size with less trouble.

Soft costs decrease as a share of CAPEX, allowing on-ground designs to benefit more from future panel cost decreases.

The Impact on OPEX

Solar on the ground has positive effects on OPEX, too.

Lower operating expenses open the possibility of ultra-low solar costs.

Long Term Implications

The Idea is More Powerful Than the Company

Erthos has a good start with several gigawatts under contract. The idea of ground-mount solar seems likely to spread far past them.

Some developers still have questions about how easy maintenance will be, if the flood-rated panels will hold up, or if the design really contains vegetation. The company is avoiding areas with high snow loads for now.

The logic of deleting many subsystems drives savings that make it worth working through a few kinks. Concentrating complexity within mega-factories while simplifying deployment gives solar an advantage in scaling rapidly.

Solar Becomes Industrial

Many environmental groups have already begun to protest solar and wind farms. Ground-mount solar is the industrialization of the solar PV ecosystem.

Solar was OK when it was expensive because it would decrease energy usage. Technology that paves the ground and makes $10/MWh electricity attainable, driving demand up, is not what Greenpeace had in mind.

Solar can still dramatically decrease land use for energy. The US uses 50 million acres just for biofuels. Solar could theoretically meet all current electricity demand plus electrify transport using less than ten million acres. Innovations like ground-mount solar and increasing panel efficiency keep reducing that number.

If solar can meet its potential and deliver $10/MWh prices, we will likely see non-grid-tied solar powering a range of industrial processes. Demand will increase significantly.

Coal is an environmental improvement over cutting down trees. Solar is an improvement on coal but isn't impact-free. Developers will have to navigate scattered opposition like any other energy technology.

The Summary

Solar won't provide 100% of our electricity, but it has a clear path to further price decreases and increasing penetration on grid and off grid.