Modeling Fuel Requirements for the Current US Military

Breaking Down Fuel Users

The Department of Defense uses ~300,000 barrels per day of fuel in peacetime, roughly 1.5% of the 19 million barrels the US consumes daily. The US is a large oil producer at 13 million barrels per day. The balance is imported, mainly from Canada and Mexico. You will see slightly different numbers depending on if the figures include natural gas liquids, exported fuels, etc. Global production and usage are ~100 million barrels per day.

The Navy and Air Force's usage will grow to >1 million barrels per day fighting in East Asia. The details of these rough estimates are in the appendix. The US military used ~45 million barrels of fuel during the Desert Storm campaign, which is in the same ballpark.

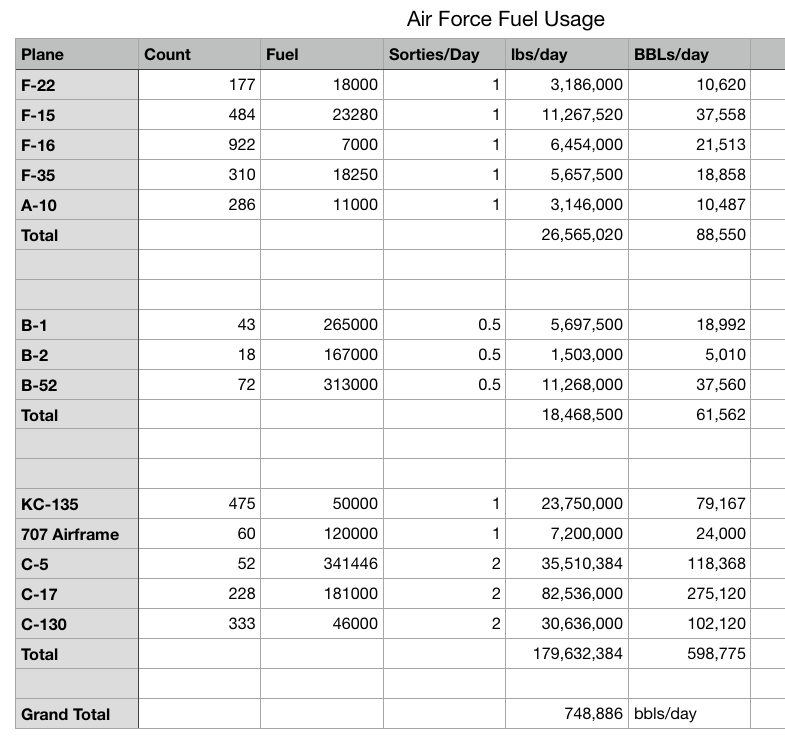

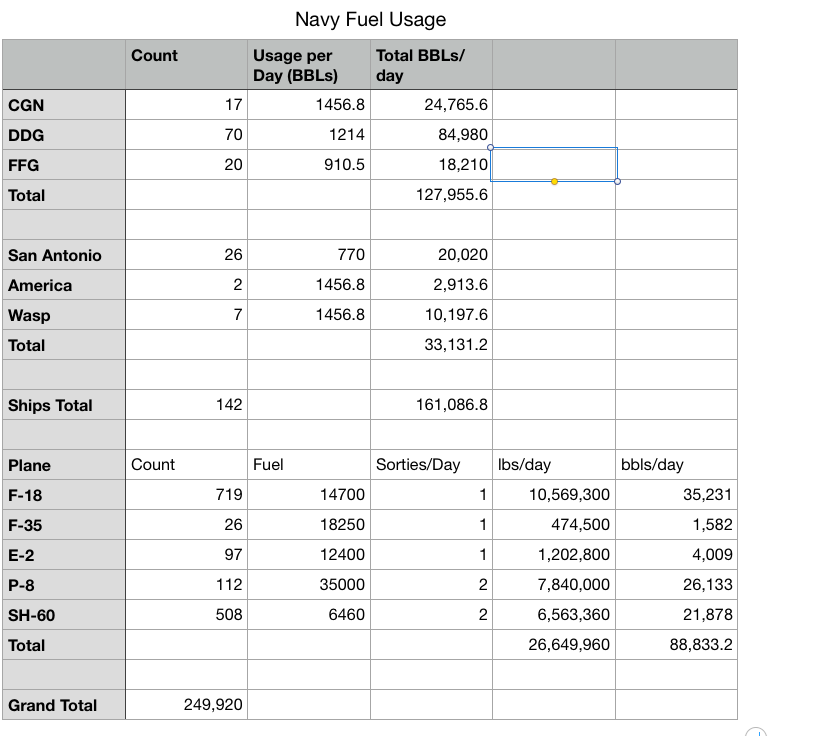

The vast majority of fuel usage is for aviation. The Air Force requires nearly 750,000 barrels per day, and Naval Aviation another 100,000 barrels per day. Warships and amphibious units only use ~160,000 barrels per day at full steam. I'm not including Army figures, but ten armored divisions would use about the same as the Navy's ships. Again, fuel usage from Desert Storm had a similar breakdown.

Within aviation, support aircraft use the most fuel. Air Force and Navy front-line fighters only use 90,000 and 35,000 barrels of jet fuel per day, assuming each aircraft burns a full tank. Cargo aircraft flying two fuel tanks per day account for 500,000 barrels a day of usage. Bomber fuel usage is relatively small because of their limited sortie rate and numbers.

Demand is small compared to global resources, but every task is harder to complete during a war.

Supplying Fuel in a High Threat Environment

Navy

The Navy must replicate its World War II strategy and fuel exclusively from the sea. There are ~20 fleet oilers that have ~150,000 barrels of capacity. Twenty oilers can shuttle fuel ~5000 kilometers at max Navy usage. The most logical thing is to load the oilers from hired, captured, or purchased commercial supertankers. Tankers typically unload offshore, pumping crude into floating hoses attached to buoys. Loading Navy oilers should be routine. There are ~650 tankers worldwide in just the Aframax classification, and ~10 could keep the Navy supplied from the US West Coast since each ship holds 500,000+ barrels.[1]

A tanker unloading at an offshore mooring point Source: LOOP

Air Force

The first task for the Air Force is to minimize aviation fuel usage at bases within range of Chinese missiles by flying support aircraft from safer rear areas. These aircraft are too valuable to be destroyed on the ground.[2] Most have crew rest options and airframes that can handle excess flight hours. Bombers will likely fly from bases in the Continental US. Cargo aircraft can avoid taking on fuel at forward bases. Pushing 90,000 barrels per day forward for fighters is less of a burden.

Guam and Okinawa are the most relevant forward bases but are challenging for the Air Force to support. Ships are the only realistic way to deliver fuel. Using commercial ships and saving oilers for the Navy is the most practical scenario. Both Guam and Okinawa have offshore mooring points for tankers. The Aframax or product tankers would be the most feasible options. A new tanker in this class costs $40-$60 million, often less than one load of fuel it carries. A John Lewis class fleet oiler with all the bells and whistles costs $640 million, making it too valuable for standard shore deliveries. The US has at least 350,000 barrels of underground fuel storage in Guam connected to the main airfield with buried pipelines. The Air Force recently hardened many of the fuel system's pumps and valves. Okinawa has buried pipelines but minimal underground storage.

Aframax ships might still be too valuable to sit hours on a known mooring site, and many dispersal fields don't have adequate infrastructure. Another option is to put temporary impoundments or welded steel tanks on open ocean barges that carry fuel to each airfield. Virtually every field is within a few thousand feet of the ocean. Crews can rapidly deploy flexible lines adapted from oilfield water transfer equipment to deliver fuel to storage or truck loading. A single line can move ~60,000 barrels per day, which will be many times any single field's usage, and the temporary impoundments range from 6000 barrels to 80,000 barrels. Trucks can take fuel to individual aircraft where underground lines are destroyed or don't exist. Temporary water transfer equipment is designed for rough field usage and constant movement, allowing daily location changes. If things are dire, another link of smaller tankers can go between the Aframax ships and the barges, but ship cost won't decline as much as capacity.

Lay flat hoses are designed for quick deployment and durability against trucks or farmers wielding shotguns. Portable diesel-powered pumps move the fluid. Source: Tetra

These tanks go up quickly with minimal tools and can move each time they are emptied. Source: Water Well Solutions

The Air Force will need 20-30 Aframax ships depending on where airlift assets get most of their fuel. Only 4-5 will be shuttling to forward bases. Since most fuel use happens in rear areas, even significant shipping losses supplying fighter bases will only moderately increase demand and overall supertanker attrition. There is an assumption that the Navy can get a portion of these commercial ships within barge range of Guam and Okinawa. The islands won't be under US control for long if the Navy lacks sea control for the task and China has the amphibious capability from a Taiwan invasion. I assume the fuel will come from the West Coast, but more tankers could bring fuel from the Gulf Coast or Europe (Aframax ships can fit through the upgraded Panama Canal). The US also has the rail capacity to transport fuel from Texas to the West in a pinch.

Modeling World War Usage

What happens when things go haywire?

How Much Can Usage Increase?

The US spends ~3.5% of GDP on the military, but we spent nearly 40% in World War II. In a worst-case scenario, fuel usage could increase 10x to ten million barrels per day.

Impacts on Global Markets

Oil product markets are inelastic in the short term, so that level of consumption would wreck markets and require extreme prices or government-mandated rationing. There are enough tankers globally to handle the load, but attrition will be significant enough to require increased production of new vessels.

There is also a high probability of a mismatch between crude oil production and refining capacity. Crude oil production happens where we can find it, but refining happens close to consumers. If the US and its allies shut off China's nine million barrels per day of seaborne crude imports, then there will be a massive surplus as refineries in China go dry. If refineries in Japan, South Korea, and Taiwan take damage, then there will be a shortage of refining capacity even without increased military consumption. A refining shortage is a thorny problem because virtually every vehicle in the US inventory uses refined products like diesel or jet fuel. The magnitude of the trend will decrease if China reduces seaborne oil imports, but the direction will stay the same.

Increasing Refined Fuel

The margins for existing refineries will be through the roof, and they will all be trying to increase production. But expansion won't happen overnight.

A faster solution might be "teapot" refining. Crude oil is a mix that contains products like wax, asphalt, diesel, or gasoline. Distillation without catalytic cracking can produce diesel and jet fuel. The yield might only be 10%-20%, but it makes sense if crude is cheap.

Many super tankers will conveniently be looking for work. The trick is that many tankers on this route are Very Large Crude Carriers (VLCCs) that need special unloading facilities. Only one port in the US can handle VLCCs, and it is out of position on the Gulf Coast. Increasing route length would lower tanker capacity. An "Operation Tea Pot" might require facilities near the trade route, like Australia, with smaller tankers ferrying crude ashore from VLCCs (the Australians sometimes unload VLCCs like this already).

Reducing or Substituting Refined Fuel Usage

Some categories may not need to increase fuel usage 10x to retain the same capability. Here are a few possible options:

-

Using More Fuel Efficient Support Aircraft:

Many of the military's support aircraft are based on the 707 airframe and use ancient engines. The replacements like the E-7 and KC-46 use significantly less fuel and require less maintenance. Even the B-52 bombers are getting new engines, and speculation suggests the B-21 sips fuel to extend range. Replacing legacy platforms with drones probably wouldn't decrease usage because of the number required to match existing capability.

-

Use Alternatives to Aircraft:

There might be some jobs better done by non-aviation platforms. Oil-fired fast transport boats could replace some airlift capacity. A steady logistics chain could reduce the relative need for airlift. Aerostat radars attached to islands or small ships might get similar results as radar planes in some cases. P-8 production might not need to increase if SOSUS-like underwater listening networks can provide locations of Chinese subs, reducing non-productive search time.

-

Ships That Use Flexible Fuel:

Modern Navy ships mostly use nuclear power (submarines, aircraft carriers) or burn refined fuel in gas turbines. Turbines are compact, lightweight, quiet, inexpensive upfront, low maintenance, and can burn jet fuel or marine diesel. The downside is they burn a lot of fuel and aren't tolerant of heavy fuel oil that many ships can burn.

More nuclear power is an alternative. Constructing a nuclear power plant in a country with streamlined regulation like South Korea is still ~4x more expensive than a gas turbine power plant. Ships probably have a similar ratio. And nuclear reactors require more training and skill than liquid fuel power plants. These aren't good features if you are trying to expand your Navy 10x in a few years.

Ships with oil-fired steam boilers can burn unrefined crude oil or heavy fuel oil. Almost all WWII Naval vessels used steam turbines with oil-fired boilers. Steam turbines have incredible power but take up a lot of space and have a lot of different parts. The upfront cost is more than turbines. The biggest concern might be if the added complexity slows ship construction time.

Almost all commercial cargo ships use massive two-stroke engines that burn heavy fuel oil. They win market share because they are affordable, reliable, and incredibly efficient, using half the fuel of turbines. Most ships hook them up directly to drive shafts, reducing cost. That also reduces top speed. Naval versions might be more practical if a few engines powered generators for an electric drive.

Turbines have great features, but unrefined crude oil will always be easier to procure. As global transportation electrifies, refining capacity could shrink, making fuel supplies even tighter during a war. Switching to designs that can use unrefined crude is at least worth consideration, but it may be better to keep using turbines.

China's Fuel Supply

Not only are China's ~9 million barrels per day of seaborne imports vulnerable, but ~30% of China's four million barrels per day of crude oil production comes from offshore platforms. Those facilities should be easy targets that are difficult to repair. The country will suffer a 75% reduction in oil supply, leaving onshore production and Russian pipeline imports. They will have excess refining capacity for any crude they can get.

China also owns ~15% of the global tanker fleet. The US Navy can task units to capture their ships if they are vulnerable after a surprise first strike.

The counterpoint is that China will be the one to choose whether to go to war and when that will be. They can accelerate the electrification of their economy, especially with buses, trucks, and e-bikes. Presumably, they can clamp down on fuel used for personal vehicles. $1000 microcars that use lead-acid batteries are already popular, so they won't have to eliminate personal driving even for the less wealthy. The economic case for the electrification of transport is strong, and the Chinese will have no problem charging vehicles with coal-fired power plants. They can also increase pipeline imports of oil and gas from Russia.

China can find enough oil for a GDP-consuming war, especially if they fight close to the mainland or use minimal airlift. It seems most likely they would make strategic moves that allow them to abandon Middle East oil imports, concentrate naval assets, and fight under land-based aircraft cover. The US still needs to cultivate allies that could assist in closing these supply lines if China tries to defend them, namely India, Australia, Indonesia, and Malaysia.

Abandoning crude imports will add other weaknesses. Wide-area electric grids are very fragile, and China doesn't have neighbors capable of supplying adequate electricity or generator fuel. China might replace some coal with distributed solar and batteries. Or they can gamble that the US will use its long-range missile inventory on targets China has been hardening for decades instead of hitting China's 1000+ coal power plants.

Oceans of Fuel

The US is in good shape for fuel supplies with a few tweaks. Using commercial ships will be important because of their availability and low cost. The military needs to pay attention to global refining capacity and China's policy towards seaborne oil imports. Long supply lines into cramped forward bases may be annoying but that is much better than having our industrial base within easy missile range of our enemies.

-

There are 800+ Very Large Crude Carriers that hold 2 million barrels, 570+ Suezmax tankers that hold 1 million barrels, 650+ Aframax tankers, and ~1000 misfits that hold a few hundred thousand barrels.

-

It is also a lot easier to build hardened shelters for fighters than large aircraft.

Appendix: Fuel Consumption Estimates

It was easier to take a picture of them, feel free to email if you'd like a copy of the spreadsheet.

Air Force

Navy

Fuel Logistics for a Pacific War

2023 March 1 Twitter Substack See all postsHow hard is it to fuel a war across a vast ocean?

Modeling Fuel Requirements for the Current US Military

Breaking Down Fuel Users

The Department of Defense uses ~300,000 barrels per day of fuel in peacetime, roughly 1.5% of the 19 million barrels the US consumes daily. The US is a large oil producer at 13 million barrels per day. The balance is imported, mainly from Canada and Mexico. You will see slightly different numbers depending on if the figures include natural gas liquids, exported fuels, etc. Global production and usage are ~100 million barrels per day.

The Navy and Air Force's usage will grow to >1 million barrels per day fighting in East Asia. The details of these rough estimates are in the appendix. The US military used ~45 million barrels of fuel during the Desert Storm campaign, which is in the same ballpark.

The vast majority of fuel usage is for aviation. The Air Force requires nearly 750,000 barrels per day, and Naval Aviation another 100,000 barrels per day. Warships and amphibious units only use ~160,000 barrels per day at full steam. I'm not including Army figures, but ten armored divisions would use about the same as the Navy's ships. Again, fuel usage from Desert Storm had a similar breakdown.

Within aviation, support aircraft use the most fuel. Air Force and Navy front-line fighters only use 90,000 and 35,000 barrels of jet fuel per day, assuming each aircraft burns a full tank. Cargo aircraft flying two fuel tanks per day account for 500,000 barrels a day of usage. Bomber fuel usage is relatively small because of their limited sortie rate and numbers.

Demand is small compared to global resources, but every task is harder to complete during a war.

Supplying Fuel in a High Threat Environment

Navy

The Navy must replicate its World War II strategy and fuel exclusively from the sea. There are ~20 fleet oilers that have ~150,000 barrels of capacity. Twenty oilers can shuttle fuel ~5000 kilometers at max Navy usage. The most logical thing is to load the oilers from hired, captured, or purchased commercial supertankers. Tankers typically unload offshore, pumping crude into floating hoses attached to buoys. Loading Navy oilers should be routine. There are ~650 tankers worldwide in just the Aframax classification, and ~10 could keep the Navy supplied from the US West Coast since each ship holds 500,000+ barrels.[1]

A tanker unloading at an offshore mooring point Source: LOOP

Air Force

The first task for the Air Force is to minimize aviation fuel usage at bases within range of Chinese missiles by flying support aircraft from safer rear areas. These aircraft are too valuable to be destroyed on the ground.[2] Most have crew rest options and airframes that can handle excess flight hours. Bombers will likely fly from bases in the Continental US. Cargo aircraft can avoid taking on fuel at forward bases. Pushing 90,000 barrels per day forward for fighters is less of a burden.

Guam and Okinawa are the most relevant forward bases but are challenging for the Air Force to support. Ships are the only realistic way to deliver fuel. Using commercial ships and saving oilers for the Navy is the most practical scenario. Both Guam and Okinawa have offshore mooring points for tankers. The Aframax or product tankers would be the most feasible options. A new tanker in this class costs $40-$60 million, often less than one load of fuel it carries. A John Lewis class fleet oiler with all the bells and whistles costs $640 million, making it too valuable for standard shore deliveries. The US has at least 350,000 barrels of underground fuel storage in Guam connected to the main airfield with buried pipelines. The Air Force recently hardened many of the fuel system's pumps and valves. Okinawa has buried pipelines but minimal underground storage.

Aframax ships might still be too valuable to sit hours on a known mooring site, and many dispersal fields don't have adequate infrastructure. Another option is to put temporary impoundments or welded steel tanks on open ocean barges that carry fuel to each airfield. Virtually every field is within a few thousand feet of the ocean. Crews can rapidly deploy flexible lines adapted from oilfield water transfer equipment to deliver fuel to storage or truck loading. A single line can move ~60,000 barrels per day, which will be many times any single field's usage, and the temporary impoundments range from 6000 barrels to 80,000 barrels. Trucks can take fuel to individual aircraft where underground lines are destroyed or don't exist. Temporary water transfer equipment is designed for rough field usage and constant movement, allowing daily location changes. If things are dire, another link of smaller tankers can go between the Aframax ships and the barges, but ship cost won't decline as much as capacity.

Lay flat hoses are designed for quick deployment and durability against trucks or farmers wielding shotguns. Portable diesel-powered pumps move the fluid. Source: Tetra

These tanks go up quickly with minimal tools and can move each time they are emptied. Source: Water Well Solutions

The Air Force will need 20-30 Aframax ships depending on where airlift assets get most of their fuel. Only 4-5 will be shuttling to forward bases. Since most fuel use happens in rear areas, even significant shipping losses supplying fighter bases will only moderately increase demand and overall supertanker attrition. There is an assumption that the Navy can get a portion of these commercial ships within barge range of Guam and Okinawa. The islands won't be under US control for long if the Navy lacks sea control for the task and China has the amphibious capability from a Taiwan invasion. I assume the fuel will come from the West Coast, but more tankers could bring fuel from the Gulf Coast or Europe (Aframax ships can fit through the upgraded Panama Canal). The US also has the rail capacity to transport fuel from Texas to the West in a pinch.

Modeling World War Usage

What happens when things go haywire?

How Much Can Usage Increase?

The US spends ~3.5% of GDP on the military, but we spent nearly 40% in World War II. In a worst-case scenario, fuel usage could increase 10x to ten million barrels per day.

Impacts on Global Markets

Oil product markets are inelastic in the short term, so that level of consumption would wreck markets and require extreme prices or government-mandated rationing. There are enough tankers globally to handle the load, but attrition will be significant enough to require increased production of new vessels.

There is also a high probability of a mismatch between crude oil production and refining capacity. Crude oil production happens where we can find it, but refining happens close to consumers. If the US and its allies shut off China's nine million barrels per day of seaborne crude imports, then there will be a massive surplus as refineries in China go dry. If refineries in Japan, South Korea, and Taiwan take damage, then there will be a shortage of refining capacity even without increased military consumption. A refining shortage is a thorny problem because virtually every vehicle in the US inventory uses refined products like diesel or jet fuel. The magnitude of the trend will decrease if China reduces seaborne oil imports, but the direction will stay the same.

Increasing Refined Fuel

The margins for existing refineries will be through the roof, and they will all be trying to increase production. But expansion won't happen overnight.

A faster solution might be "teapot" refining. Crude oil is a mix that contains products like wax, asphalt, diesel, or gasoline. Distillation without catalytic cracking can produce diesel and jet fuel. The yield might only be 10%-20%, but it makes sense if crude is cheap.

Many super tankers will conveniently be looking for work. The trick is that many tankers on this route are Very Large Crude Carriers (VLCCs) that need special unloading facilities. Only one port in the US can handle VLCCs, and it is out of position on the Gulf Coast. Increasing route length would lower tanker capacity. An "Operation Tea Pot" might require facilities near the trade route, like Australia, with smaller tankers ferrying crude ashore from VLCCs (the Australians sometimes unload VLCCs like this already).

Reducing or Substituting Refined Fuel Usage

Some categories may not need to increase fuel usage 10x to retain the same capability. Here are a few possible options:

Using More Fuel Efficient Support Aircraft:

Many of the military's support aircraft are based on the 707 airframe and use ancient engines. The replacements like the E-7 and KC-46 use significantly less fuel and require less maintenance. Even the B-52 bombers are getting new engines, and speculation suggests the B-21 sips fuel to extend range. Replacing legacy platforms with drones probably wouldn't decrease usage because of the number required to match existing capability.

Use Alternatives to Aircraft:

There might be some jobs better done by non-aviation platforms. Oil-fired fast transport boats could replace some airlift capacity. A steady logistics chain could reduce the relative need for airlift. Aerostat radars attached to islands or small ships might get similar results as radar planes in some cases. P-8 production might not need to increase if SOSUS-like underwater listening networks can provide locations of Chinese subs, reducing non-productive search time.

Ships That Use Flexible Fuel:

Modern Navy ships mostly use nuclear power (submarines, aircraft carriers) or burn refined fuel in gas turbines. Turbines are compact, lightweight, quiet, inexpensive upfront, low maintenance, and can burn jet fuel or marine diesel. The downside is they burn a lot of fuel and aren't tolerant of heavy fuel oil that many ships can burn.

More nuclear power is an alternative. Constructing a nuclear power plant in a country with streamlined regulation like South Korea is still ~4x more expensive than a gas turbine power plant. Ships probably have a similar ratio. And nuclear reactors require more training and skill than liquid fuel power plants. These aren't good features if you are trying to expand your Navy 10x in a few years.

Ships with oil-fired steam boilers can burn unrefined crude oil or heavy fuel oil. Almost all WWII Naval vessels used steam turbines with oil-fired boilers. Steam turbines have incredible power but take up a lot of space and have a lot of different parts. The upfront cost is more than turbines. The biggest concern might be if the added complexity slows ship construction time.

Almost all commercial cargo ships use massive two-stroke engines that burn heavy fuel oil. They win market share because they are affordable, reliable, and incredibly efficient, using half the fuel of turbines. Most ships hook them up directly to drive shafts, reducing cost. That also reduces top speed. Naval versions might be more practical if a few engines powered generators for an electric drive.

Turbines have great features, but unrefined crude oil will always be easier to procure. As global transportation electrifies, refining capacity could shrink, making fuel supplies even tighter during a war. Switching to designs that can use unrefined crude is at least worth consideration, but it may be better to keep using turbines.

China's Fuel Supply

Not only are China's ~9 million barrels per day of seaborne imports vulnerable, but ~30% of China's four million barrels per day of crude oil production comes from offshore platforms. Those facilities should be easy targets that are difficult to repair. The country will suffer a 75% reduction in oil supply, leaving onshore production and Russian pipeline imports. They will have excess refining capacity for any crude they can get.

China also owns ~15% of the global tanker fleet. The US Navy can task units to capture their ships if they are vulnerable after a surprise first strike.

The counterpoint is that China will be the one to choose whether to go to war and when that will be. They can accelerate the electrification of their economy, especially with buses, trucks, and e-bikes. Presumably, they can clamp down on fuel used for personal vehicles. $1000 microcars that use lead-acid batteries are already popular, so they won't have to eliminate personal driving even for the less wealthy. The economic case for the electrification of transport is strong, and the Chinese will have no problem charging vehicles with coal-fired power plants. They can also increase pipeline imports of oil and gas from Russia.

China can find enough oil for a GDP-consuming war, especially if they fight close to the mainland or use minimal airlift. It seems most likely they would make strategic moves that allow them to abandon Middle East oil imports, concentrate naval assets, and fight under land-based aircraft cover. The US still needs to cultivate allies that could assist in closing these supply lines if China tries to defend them, namely India, Australia, Indonesia, and Malaysia.

Abandoning crude imports will add other weaknesses. Wide-area electric grids are very fragile, and China doesn't have neighbors capable of supplying adequate electricity or generator fuel. China might replace some coal with distributed solar and batteries. Or they can gamble that the US will use its long-range missile inventory on targets China has been hardening for decades instead of hitting China's 1000+ coal power plants.

Oceans of Fuel

The US is in good shape for fuel supplies with a few tweaks. Using commercial ships will be important because of their availability and low cost. The military needs to pay attention to global refining capacity and China's policy towards seaborne oil imports. Long supply lines into cramped forward bases may be annoying but that is much better than having our industrial base within easy missile range of our enemies.

There are 800+ Very Large Crude Carriers that hold 2 million barrels, 570+ Suezmax tankers that hold 1 million barrels, 650+ Aframax tankers, and ~1000 misfits that hold a few hundred thousand barrels.

It is also a lot easier to build hardened shelters for fighters than large aircraft.

Appendix: Fuel Consumption Estimates

It was easier to take a picture of them, feel free to email if you'd like a copy of the spreadsheet.

Air Force

Navy